Contact Us Today to Discover Your Debt Consolidation Loan Choices

Contact Us Today to Discover Your Debt Consolidation Loan Choices

Blog Article

Why a Debt Combination Lending Might Be the Perfect Remedy for Your Financial Struggles and Tension Alleviation

A financial debt combination financing provides a chance to improve these obligations, possibly decreasing both passion rates and monthly settlements. By combining your debts, you can shift focus from handling numerous lenders to a solitary, extra workable repayment, leading the means for boosted financial security.

Comprehending Financial Obligation Combination Car Loans

Financial obligation loan consolidation finances act as a monetary device that permits individuals to integrate multiple financial obligations right into a single finance, preferably with a lower rate of interest and even more convenient repayment terms. This strategy can improve economic management by lowering the variety of monthly payments, supplying a clearer path to financial debt repayment.

Commonly, these lendings can be safeguarded or unprotected. Safe finances require collateral, which may lead to reduced rate of interest rates but brings the threat of losing the property if payments are not fulfilled. Unsafe loans do not need security but may have greater rate of interest because of the raised risk to the lender.

When taking into consideration a financial debt consolidation car loan, it is crucial to examine the complete expense of the lending, consisting of any type of fees or charges that might use, as well as the rates of interest compared to existing financial obligations. Additionally, a detailed understanding of one's credit report is essential, as it considerably affects finance qualification and terms.

Eventually, financial debt consolidation fundings can provide a viable option for those bewildered by multiple financial obligations, yet mindful consideration and planning are essential to guarantee they align with private financial objectives.

Benefits of Debt Debt Consolidation

One of the primary advantages of combining your debts is the possibility for minimized monthly settlements. By combining multiple high-interest financial obligations right into a single funding, customers commonly gain from a lower rates of interest, which can cause significant financial savings over time. This streamlined approach not only simplifies economic administration yet additionally alleviates the anxiety related to juggling numerous payments and due days.

In addition, debt loan consolidation can enhance credit report. When several financial debts are repaid and consolidated into one account, it can improve your credit score application ratio, which is an essential element of credit report. With time, with constant repayments, this enhancement can better boost your credit history profile.

In addition, loan consolidation can supply a structured repayment plan. Numerous financial obligation consolidation lendings provide taken care of terms, enabling borrowers to understand precisely when their financial obligation will certainly be repaid, fostering a feeling of control and economic stability.

Finally, the emotional relief that comes from lowering the number of creditors to handle can be substantial. consolidation loan singapore. Less suggestions and costs can cause reduced anxiety, allowing individuals to concentrate on rebuilding their financial health and wellness and attaining long-term objectives

Just How to Get a Financing

Browsing the needs for qualifying for a financial obligation combination lending entails comprehending several essential variables that lending institutions consider. Firstly, your credit history rating plays an important duty. A higher rating generally suggests to lending institutions that you are a low-risk debtor, boosting your opportunities of authorization and beneficial rates of interest. Usually, a rating of 650 or greater is preferred, although some lending institutions might suit lower ratings with greater rates of interest.

Along with credit history, your income and employment stability are vital components. Lenders desire assurance that you have a trustworthy revenue resource to sustain funding repayments (consolidation loan singapore). Offering documentation such as pay stubs or tax obligation returns can enhance your application

An additional important element is your debt-to-income (DTI) ratio, which compares your month-to-month financial debt settlements to your gross monthly earnings. By recognizing these crucial factors, you can much better prepare on your own for the car loan application procedure and improve your possibilities of securing a debt loan consolidation finance tailored to your needs.

Actions to Settle Your Financial Debt

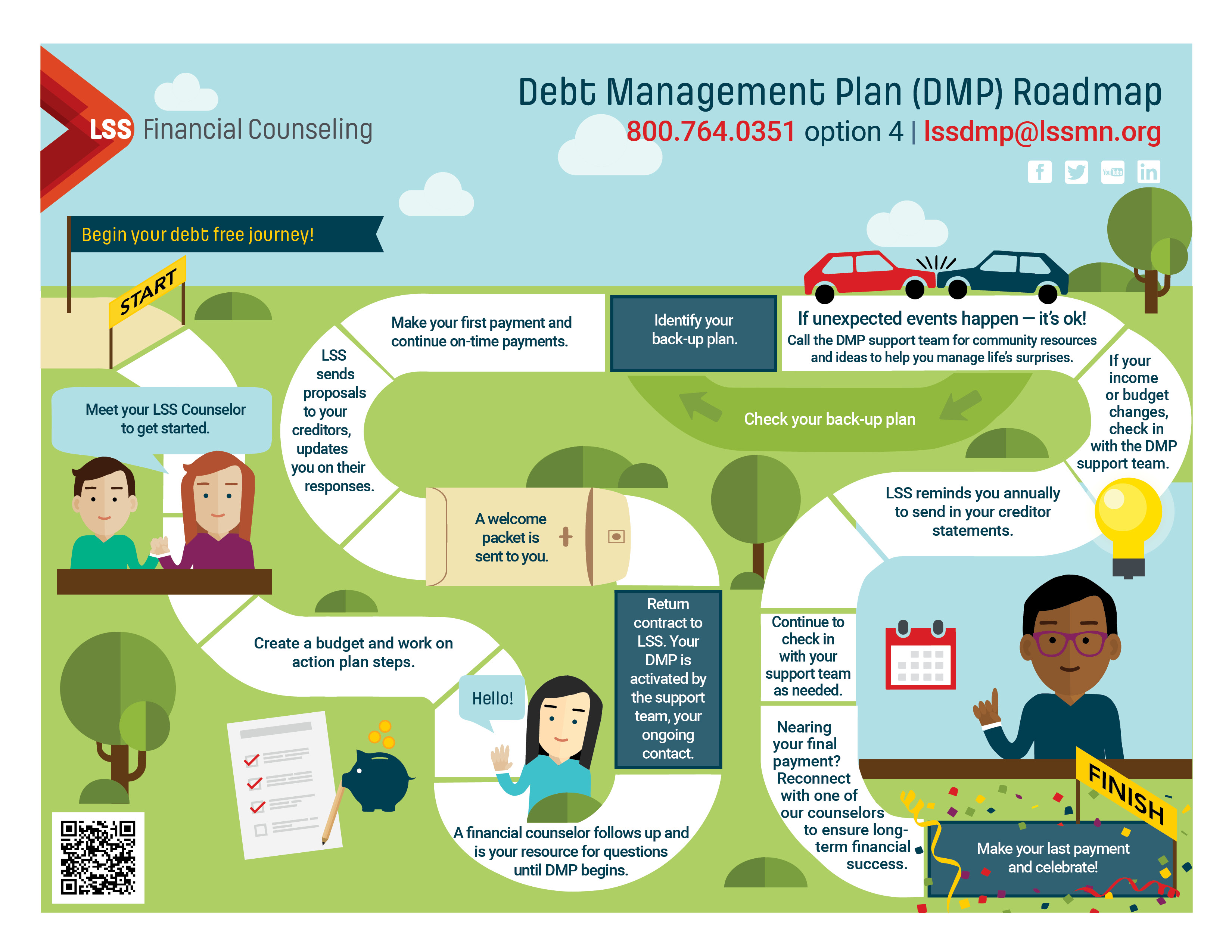

Next, discover your loan consolidation alternatives. This may consist of obtaining a financial debt combination lending, using an equilibrium transfer charge card, or enrolling in a debt monitoring plan. Each option has its prospective risks and own advantages, so it's important to choose one that straightens with your financial objectives.

After picking an appropriate approach, obtain the chosen funding or credit product. Guarantee you fulfill the essential certifications and give all needed paperwork. Once authorized, utilize the funds to settle your existing financial debts completely, consequently simplifying your economic commitments right into a solitary monthly repayment.

Typical Mistakes to Prevent

When embarking on the journey of financial debt combination, preventing typical challenges is critical for achieving financial stability. One major mistake is falling short to completely evaluate the terms of the funding. High interest prices or hidden costs can negate the benefits of consolidating. Always contrast several offers to guarantee you protect the finest offer.

An additional constant error is not addressing hidden spending practices. Consolidating debt does not get rid of the origin of economic problems; continuing to accrue debt can result in a cycle of financial strain. Produce a budget to check spending and stay clear of dropping back right into old behaviors.

Additionally, some individuals forget the importance of maintaining a great credit rating. A lower rating can cause greater passion rates or loan denial. Frequently examine your credit history record and resolve any inconsistencies prior Click Here to obtaining a Our site consolidation loan.

Consulting with a monetary consultant can offer beneficial understandings customized to your details circumstance. By identifying these usual blunders, you can take significant actions toward an effective debt consolidation trip and, inevitably, financial flexibility.

Conclusion

:max_bytes(150000):strip_icc()/good-debt-bad-debt.asp_Final-ad0f73162100435486bf302829acffef.jpg)

A financial obligation combination financing offers a possibility to simplify these commitments, possibly decreasing both passion prices and monthly payments.Browsing the needs for qualifying for a financial obligation consolidation car loan entails comprehending several vital aspects that lenders consider. By understanding these crucial factors, you can much better prepare yourself for the lending application procedure advice and enhance your possibilities of safeguarding a financial debt combination finance tailored to your needs.

Consolidating financial debt does not get rid of the root reason of financial problems; continuing to accumulate financial obligation can lead to a cycle of economic stress.In verdict, a financial debt loan consolidation loan offers a practical alternative for individuals looking for to relieve economic burdens and simplify financial obligation administration.

Report this page